How to Escape the Trap of Debt Collections

07/25/2024

We associate quite a few things with American iconography - the flag, apple pie, baseball, and the Statue of Liberty- but there's nothing more American than having debt. It isn't necessarily a bad thing, it's part of our financial system. Maybe you've gotten student loans to go to college, or you're paying an auto loan every month so that you don't have to spend tens of thousands of dollars out of pocket. Debt is one of the best things you can do to build your credit score. You can do this by regularly making payments on your owed balance, keeping your credit utilization low, and showing lenders that you're a responsible individual. In 2023, Americans generated $5.82 trillion dollars in purchasing volume with credit cards (Nilson Report Issue 1258). That's trillion with a t.

What happens if you can't pay that debt? No, you don't have to worry about the trillions of dollars Americans spent, but you do need to worry about the money that you borrowed. When you sign a loan agreement or swipe your credit card, you are spending money that is not your own, with a financially binding promise to pay it back. Things happen; you're only human, and we all make mistakes or run into financial difficulties, but it's important to know what happens to your debt when you fail to pay it.

NOT QUITE SHARKS

Let's put together a little exemplary situation to illustrate how things operate. The fictional you gets an auto loan for a brand new car; your old one just wasn't cutting it, but your new baby blue wheels? Well, they're the talk of the town. Every month, you pay a little over your agreed minimum loan payment on the 15th. You've never missed a day; you have reminders in your phone and notes on your calendar, and you think about it every time you start the engine.

You will never, ever forget.

Then the 15th rolls around one month, and you forget. Whoops. Then the 16th passes, the 17th, etc. You missed your payment because you didn't set up auto payments, or maybe funds are a little tight, and you've been so stressed that it slipped your mind. The loan provider notifies you of the missed payment, and your credit score might get dinged - but you still forget to pay it. It keeps slipping further and further away.

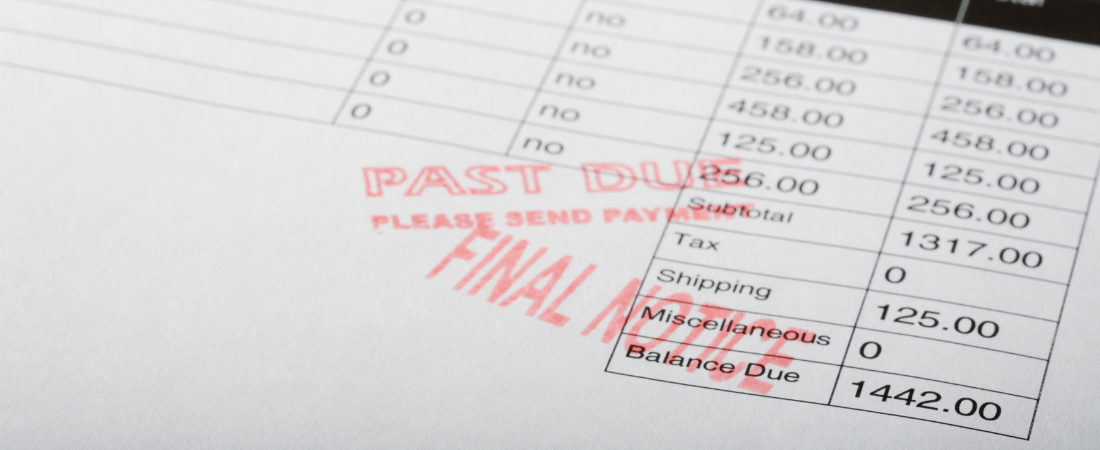

Eventually, when the provider grows tired of chasing you down, the debt will go to collections and be offloaded to a collection agency. The collection agency will chase you down - phone calls, emails, letters, and anything they can do to reach you. If you duck them long enough, they might try to have your wages garnished or, even worse, have a lien placed on something that you own. Do you really want to deal with that pressure weighing on you every day?

Are You Really Surprised?

If debt goes to collections, there's no way to act like you're surprised - the loan provider no doubt tried to reach out on multiple occasions to notify you about the problem. Listen, it's understandable not to want to answer phone calls from numbers you don't recognize - especially with how prevalent spam calls have become, but it's important to be aware of your debts. Still, things happen - once, I had a medical bill I didn't know about (for $23.75) go to collections. When you learn about the debt, it's essential to pay it off as soon as you're able.

More importantly, you should work with your providers if you run into trouble. If Atlantic provided you with the loan and something happened – please reach out to the Member Solutions Team. You can call or text at 207-835-8995. They are a highly skilled team who specialize in helping members through financial hardships without judgment.

Don't ignore the problem, and hope that it goes away. Reach out to your financial institution ASAP to rectify the situation. No one wants to send debt to collection agencies. But if you ignore correspondence from your loan providers, you're just making the problem worse.

So, Uh, What Should I Do?

If you receive notification from a collections agency, the first thing you should do is verify it's not fraud. Check it against your credit report or reach out to the originator of the loan to see if it's gone to collections.

Once you know it's real - it's time to pay up. Reach out to the agency that sent you the notice. You can no longer pay the original creditor because they've sold your debt to a collection agency. If you can't pay everything at once, there's a good chance the collection agency will have a payment plan or be open to negotiations. At the end of the day, they just want their money, and if you're willing to work with them, that's better than continuing to ignore their notices.

DON'T IGNORE THEM

Maybe you think you've gone this long without paying, surely you can continue getting away with it, right? So wrong, just absolutely astoundingly wrong. Don't think that. Bad.

Continuing to ignore correspondence and refusing to pay will result in further damage to your credit score and finances. Need an emergency loan to fix that big hole in your roof? Too bad your credit plummeted after you ran away from debt collectors.

Beyond that, the collections agency might take you to court, or your property may be repossessed. Say goodbye to that nice baby blue car.

BE PROACTIVE, NOT REACTIVE

Here are some simple steps you can take to avoid your debt slipping away from you.

- Never miss a payment again by setting up auto payments!

- If you're struggling to juggle multiple debts and payments - consider applying for a debt consolidation loan. Worry about one monthly payment and potentially secure a lower interest rate.

- Reach out to your loan provider as soon as you can and work with them if you fall behind.

- DON'T IGNORE COMMUNICATIONS FROM YOUR FINANCIAL PROVIDER.

We're Here to Help

If you run into trouble, please reach out to Atlantic. Our motto is Helping People Do Better, and that includes you. Try to rectify your debt before it goes to collections, and if it does - do everything in your power to pay it off immediately to limit further harm to yourself.

If you need help paying off your bill, consolidating your debt, or need any financial assistance, please visit any of our branch locations or call 800-384-0432. We're here for you!

Stay up to date and join our email list.

The Atlantic blog strives to deliver informative, relevant, and sometimes fun financial information. If you enjoyed this article, please forward it to a friend.

Source:

“Issue 1258.” Nilson Report, 1 Mar. 2024.

Each individual’s financial situation is unique, and readers are encouraged to contact the Credit Union when seeking financial advice on the products and services discussed. This article is for educational purposes only; the authors assume no legal responsibility for the completeness or accuracy of the contents.