Protect What Matters Most: Embrace Multifactor Authentication Now

02/13/2025

Do you have a separate password for every website and account? Do you make sure they're strong, hard to crack (and hard to remember)? Then you've taken a great first step to protecting yourself from fraud and hackers - but in an age of constant leaks, evolving viruses, and social engineering, having a strong password isn't enough to keep you safe. Don't panic; there are easy steps you can take to make sure you're more secure.

We're going to break down Multifactor Authentication (MFA), and by the time we're done, you'll be a security expert.

Soooo What IS MFA?

You've probably heard the term before, or one of its many, many synonyms (2-Step Verification, Two Step Authentication, 2FA, and a thousand more, you get the gist). MFA is a secondary layer of security for your online accounts and the data attached to them. We HIGHLY recommend activating it on all your accounts that hold sensitive information.

Think of it like putting a fingerprint scanner on your front door - it's one more line of defense to protect YOU and what matters to you.

Always utilize it if it's available; it's a simple step that can save you a LOT of headaches when hackers start looking for weakness.

We All LOVE Options

Okay, I think you can see WHY you should have MFA active on your accounts, but what's available? It can differ depending on the account, but usually:

- TEXT/VOICE: You'll receive a text or voice message containing a code you'll need to enter on whatever website you're logging into to finish unlocking your account.

- FINGERPRINTS/FACE: You might already use this to unlock your phone - but some accounts will allow you to store a fingerprint or face scan that can be used to unlock your account.

- EMAIL: When you try to log into your account, an email will be sent to the attached address with a code you need to enter in a set amount of time.

- APP BASED: You use an authenticator app on your phone that is linked to your accounts and constantly rotates through timed authentication codes.

The tech industry is always developing new forms of authentication and security to combat ever-evolving attempts from scammers, hackers, and fraudsters. Each has its strengths and weaknesses, but which is the MOST secure?

CHOOSE ME

In an ideal world, we wouldn't need the extra security - but we do, so let's choose the best.

Text is convenient, easy, and fast, BUT it's also the most open to security breaches. A hacker trying to get into your account could spoof your sim card so they receive your authentication messages, OR they could call up the phone carrier and claim to be you, that you lost your phone and need to activate a new one. If they're reaaaal convincing - there goes your security. It's time to start considering switching from texting to a new form of authentication.

Using email might be easy if you have it open – but you run into real trouble if you lose access to your account or if a hacker manages to worm their way into your email. They could reverse engineer all of your important information, accounts, and MORE. It's unsafe, and I suggest you transition away from using it. As companies re-assess changing security concerns, email MFA will become rarer, and we plan to phase it out for logging into Digital Banking in the future.

A fingerprint can get you in with just a tap of a finger, but how many videos have we seen of kids pulling a prank on their sleeping parents by using their fingers to unlock their phones? You're not going to find yourself in some elaborate Mission Impossible scenario where Tom Cruise is making a mold of your finger to hack into your accounts - but it's not as secure as it could be.

App-based authentication is secure, regulated thanks to its cycling timed codes, and easy to use. We HIGHLY recommend that you get an authenticator app that you trust and start utilizing it. HOWEVER, if you lose your phone - trouble brews.

So, uh, How DO I Enable MFA?

There are no bad questions - never feel ashamed to ask. If you haven't already set up multifactor authentication for your accounts at Atlantic, now is the PERFECT time.

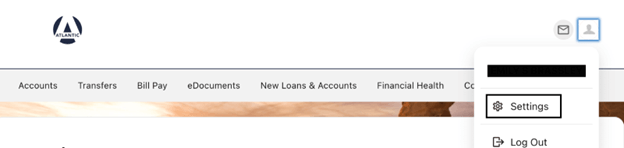

- Log into your account through Digital Banking via a web browser. (This feature is not available to edit via the mobile app.)

- Select your account icon to navigate to Settings.

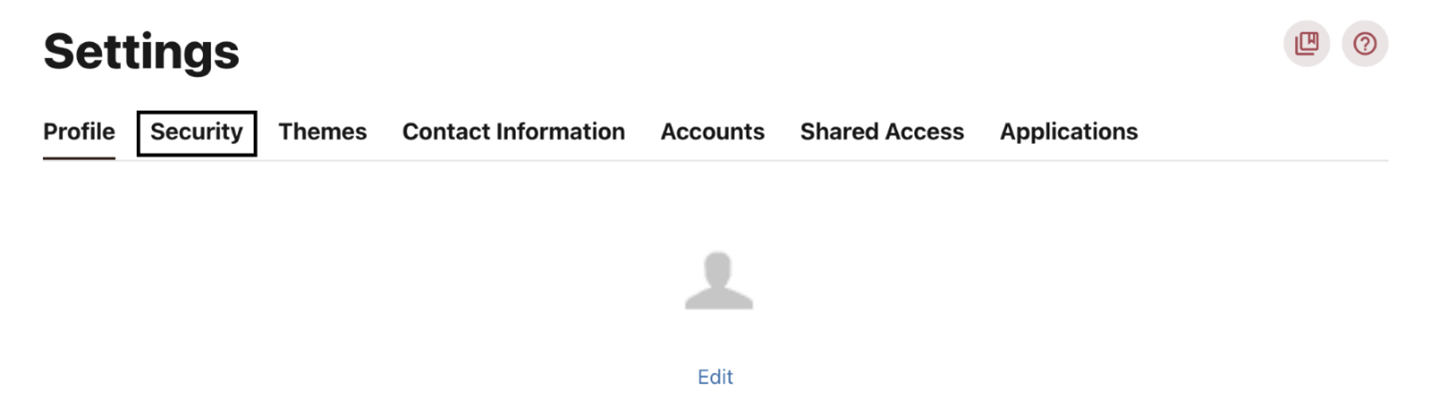

- Select the Security tab!

- Toggle on the Require Two-Factor Authentication for Each Login.

- Select the pencil icon for the MFA you’d like to set up and attach to your account.

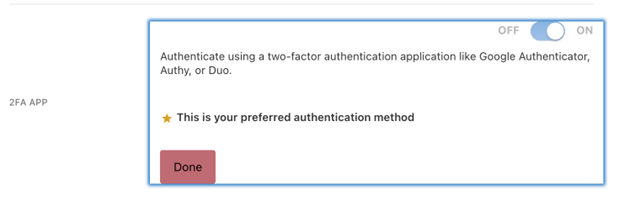

- If using the 2FA App, you will need to open the app on your phone to link the two. Some of the popular authenticator apps are Microsoft Authenticator, Google Authenticator, Authy, or Duo.

It's really that easy.

We're Here to Help!

Now that you know what it is, you'll see multifactor authentication prompts everywhere. Just remember - when it's available ALWAYS opt in. It's never a bad choice to prioritize protecting yourself.

Not sure where to look? Check the security settings on your most-used accounts. You'll probably see options to enable MFA listed as "Two Factor Authentication," "Multifactor Authentication," or "Two Step Factor Authentication." Turn them on, and sleep a little sounder, knowing you've upped your digital security.

If you suspect you were targeted by a scam or have been a victim of fraud, please contact us immediately. Financial security is our top priority, and we are here to assist you through any concerns or issues you may encounter. Please stop by any of our convenient branch locations or call 800-834-0432 to schedule an appointment today.

Stay up to date and join our email list.

The Atlantic blog strives to deliver informative, relevant, and sometimes fun financial information. If you enjoyed this article, please forward it to a friend.

Each individual’s financial situation is unique and readers are encouraged to contact the Credit Union when seeking financial advice on the products and services discussed. This article is for educational purposes only; the authors assume no legal responsibility for the completeness or accuracy of the contents.